Foreign Direct Investment in Nepal

Frequently Asked Questions

FAQ 2

This page is under construction!

FAQ Home |

FAQ1 |

FAQ2 | FAQ3

Repatriation of Investment and Earnings

Q. What is the provision for repatriation of foreign investment?

Repatriation approval is given by the Central Bank on recommendation from the concerned foreign investment approving body (IBN/DOI) within 15 working days of application submission. Repatriation can be done after all taxes are fully paid and all necessary legal obligations have been met. NRB shall also provide exchange facility to the foreign investors for repatriation. In some cases, the foreign investment approving bodies (IBN/DOI) may grant approval for repatriation.

Q: What are the amounts allowed to repatriate?

- Amount received from sale of shares with foreign investment

- Amount of profit or dividend received from foreign investment

- In the case of liquidation or winding up of the industry or company, amount remaining after paying all liabilities following the liquidation or winding up

- Amount of royalty received under the technology transfer agreement

(Provided that in the case of the royalty or fee for the use of a trademark under the transfer of technology in a liquor industry other than a liquor industry exporting cent percent of liquor, the amount of such royalty shall not exceed five percent of the total selling price, as prescribed, excluding the prevailing tax.)

- Amount of lease rent under the lease investment

- Amount received as damages or compensation, if any, received from the final settlement of a law suit, arbitration or any other legal process in Nepal

- Amount that can be repatriated in accordance with the prevailing law

Q: What are the documents required for repatriation?

- Approval from the concerned foreign investment approving body

- Copy of the minutes of annual general meeting, or board of directors, or authorized officer of the company/ industry with foreign investment for foreign exchange approval

- Copy of the letter of FDI recording in NRB

- Copy of the current audit Report

- Copy of the last tax clearance certificate or proof of tax details submission

- Proof of the company/industry not being blacklisted by the Credit Information Bureau (CIB) of Nepal

- A self-declaration stating that the company/industry does not have any outstanding loan pending in BFIs, engagement in embezzling of foreign currency, outstanding liabilities as well as compliance to the national and international laws on anti-money laundering and combating the financing of terrorism

- In case of royalty from technology transfer, copy of details of royalty as per the technology transfer agreement certified by a Chartered Accountant and invoice issued by the concerned investor

- For unlisted companies, copy of due-diligence audit report stating the valuation of price per share

- Proof of deposit of advance income tax and VAT on the amount remitted as per the prevailing laws

Q: What are the documents required for repatriation of income?

- Application and copy of Industry, Company Registration Certificate

- Copy of Approval for Foreign Investment

- Minutes of the meeting of the Board of Directors

- Approved Share Purchase Agreement

- AGM decision on paying dividend

- Copy of the Approved Loan Agreement or an attested copy of the decision regarding compensation

- Copy of approved Agreement of Technology Transfer and Lease Investment

- Copy of current Audit Report, Tax Clearance Certificate, and notarized copy of the letter of being not blacklisted

- Copy of the list of promoters and share-holders documented in the Company Registrar’s Office

- Letter of FDI recording in Nepal Rastra Bank

- Document showing the amount received from the sale of share

- Royalty Calculation by Certified Chartered Accountant

- Copy of the document showing the amount paid as the principal or interest on foreign investment

Labor and Employment

Q: What are the governing laws and authorities to regulate employment in Nepal?

The matter relating to employment in Nepal is primarily governed by:

i. The Labor Act 2017, (2074) (“Labor Act”) and

ii. The Labor Rules 2018, (2075) (“Labor Rules”) in Nepal

iii. The Contribution Based Social Security Act, 2017 (2074) (“Social Security Act”)

iv. The Contribution Based Social Security Rules, 2018 (2075) (“Social Security Rules”)

v. The Social Security Schemes Directives, 2018 (2075) (“Social Security Directives”)

vi. The Trade Union Act, 1992 (2049) (“Trade Union Act”)

vii. The Trade Union Rules, 1994 (2050) (“Trade Union Rules”)

viii. The Bonus Act, 1973 (2030) (“Bonus Act”)

ix. The Bonus Rules, 1982 (2039) (“Bonus Rules”)

x. The Foreign Employment Act, 2007 (2064) (“Foreign Employment Act”)

xi. The Child Labor (Prohibition and Regulation) Act, 2000 (2056) (“Child Labor Prohibition Act”)

xii. The Right to Employment Act, 2018 (2075) (“Employment Act”)

xiii. The Right to Safe Motherhood and Reproductive Health Act, 2018 (2075) (“Safe Motherhood

xiv. The Sexual Harassment at Workplace Prevention Act, 2015 (2072) (“Sexual Harassment at

Workplace Act”)

All the laws enlisted above could be collectively accessed in “Labor Laws.” Employment-related matters are regulated by the Department of Labor (“DOL”) and the Labor Office.

Q: When can a company hire foreign national?

Section 4A of The Labor Act restricts any foreign nationals to work in Nepal without obtaining work permit. The

foreign nationals

(a) having diplomatic immunity, or

(b) who are not required to obtain a work permit under a treaty or agreement entered into with the GON are however exempted from the work permit requirement.

The hiring process of foreign nationals varies based on the work or nature of the local entity. The

foreign nationals may be hired

(a) if local skill set is not available, or

(b) by the foreign investment company up to certain numbers, or

(c) for short term technical work.

Exiting from Business

Q: What is the validity period of approval of foreign investment?

The approval for foreign investment remains valid as long as the investment stays in Nepal. However, the approval becomes invalid if: (a) The investor fails to bring the investment to Nepal within two years without a valid reason, (b) Full ownership of the industry is transferred to a Nepali investor through a sale of shares, (c) The industry loses its registration due to non-compliance or default. Other conditions for the validity period will be set as per regulations.

Dispute Resolution:

Q: What are the laws governing dispute resolution in Nepal?

Generally, disputes are resolved in two ways: (a) Courts and Tribunals or (b) Arbitration. The Constitution

of Nepal, the Administration of Justice Act, 2016 (2073), the Supreme Court Act, 2016 (2073), the

Supreme Court Regulations, 1992 (2049), the High Court Regulations, 2016 (2073), District Court

Regulations, 2016 (2073), Country Civil Procedure Code, 2017 (2074), Country Criminal Code, 2017

(2074), Country Criminal Procedure Code, 2017 (2074) deal with judicial proceedings in regular courts.

The matters relating to arbitration is primarily governed by the Arbitration Act, 1998 (Arbitration Act)

and Arbitration (Court Procedures) Rules, 2002 in Nepal.

Q: What is the provision to settle legal disputes between a native and a foreign investor?

Section 40 of FITTA, 2019 states that if a dispute arises between a Nepali investor and a foreign investor regarding foreign investment, the Department will facilitate efforts for the parties to resolve the issue through mutual discussions or negotiations. If the dispute is not settled within 45 days, and there is a joint investment or dispute settlement agreement in place, the dispute will be resolved according to that agreement. The parties must inform the Foreign Investment Approving body about the settlement within 15 days, though they are not required to disclose the specific terms of the settlement.

If no agreement exists regarding dispute resolution, the dispute will be settled through arbitration according to Nepal's arbitration laws. For any foreign investment-related dispute, arbitration will generally follow the Rules or Procedures of the United Nations Commission on International Trade Law (UNCITRAL), unless the parties agree otherwise. Arbitration will take place in Nepal, following Nepalese arbitration laws. If no prior agreement exists for dispute resolution, or if the existing agreement is inadequate, the parties can make a new agreement after the dispute arises. This agreement must be reported to the body that registered the industry. Disputes related to this new agreement can also be settled under these provisions.

Q: What is the mechanism for the recognition and enforcement of foreign arbitral award?

The disputes that are commercial in nature can be referred to arbitration for settlement. If there has been any arbitration agreement between the parties in dispute, then the dispute should be referred to the arbitration. The Arbitration Act provides for the arbitration proceedings. The courts of Nepal do not hear any commercial disputes so far as there has been an arbitration agreement.

- The foreign arbitral award is enforced in Nepal in two conditions, viz.

(a) if Nepal is party to any treaty related to enforcement of foreign arbitral award, and

(b) the award is rendered in the territory of the party to that treaty subject to the conditions set out at the time of being party to that treaty.

- Nepal is a party to the New York Convention on the Recognition and Enforcement of Foreign Arbitration Award 1957 (“New York Convention”). Nepal has ratified the New York Convention with such declarations that it enforces the foreign arbitral award (a) on the basis of reciprocity and (b) given on disputes commercial in nature under the law of Nepal.

- The Arbitration Act sets out the conditions to be satisfied for the enforcement of foreign arbitral award in Nepal. Upon the satisfaction of such conditions the foreign arbitral award can be enforced in Nepal.

- The petition for enforcement of foreign arbitral award should be submitted to the High Court.

- The High Court can forward the foreign arbitral award to the District Court if it is enforceable.

- Both India and Nepal are signatory to the New York Convention which obliges the countries to recognize the foreign arbitral award on the basis of reciprocity. In the context of India, we understand that only 48 countries have been notified by the Central Government of India as reciprocating countries, which does not include Nepal. Therefore, Nepal is not obliged to enforce the Indian arbitral award on the basis of reciprocity.

FNCCI’s Role and Support

Q: How can FNCCI help foreign investors navigate the FDI process?

FNCCI in collaboration with the Investment Board Nepal has established a help desk in order to ensure that foreign investors are well-informed about the regulatory requirements and well-equipped with market intelligence to venture into Nepal after carefully considering its policies, visa-related issues, and the local context of investments.

It Provides services related to registration, operation of a business, and exit of an industry from a single window operated by the private sector. And, help foreign investors in meeting compliance regarding issues such as investment approval, securing labor permits, visa facilities, foreign exchange, and environmental compliance, among others.

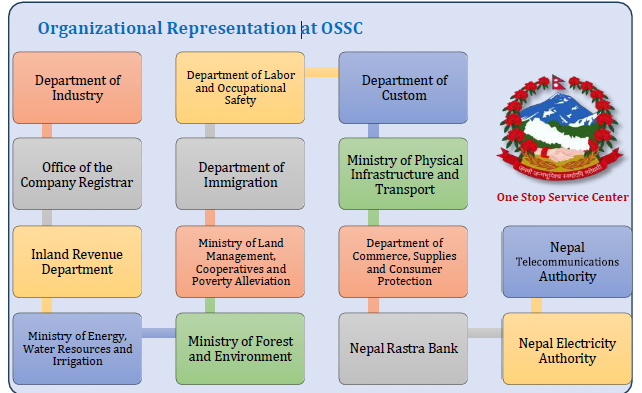

One Stop Service Centre

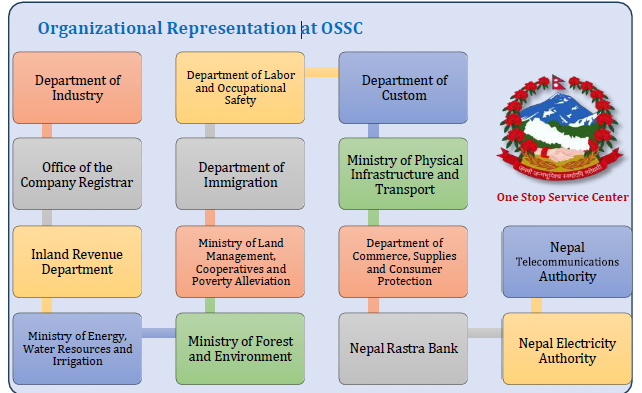

The One Stop Service Center (OSSC) was set up within the Department of Industry on May 15, 2019, following a directive published in the Nepal Gazette on April 29, 2019, to support both foreign and domestic investors. OSSC provides a range of services, including foreign investment approvals, visa recommendations for foreign investors, their authorized representatives, and foreign experts, as well as support with Initial Environmental Examinations (IEE), Environmental Impact Assessments (EIA), foreign currency exchange, and related services. The center consolidates representation from 14 organizations and nine facilitation units, all under one roof, to streamline assistance for investors which are enlisted below in the chart.

Miscellaneous

Q: What is the legal framework for ensuring equal treatment for investors in Nepal?

Section 32 of FITTA, 2019 states that foreign investment shall be granted national treatment. Clause 45 and Sub-clause (5) of the Public-Private Partnership and Investment Act 2019, also mention foreign investment projects in Nepal will receive the same treatment as domestic industries.

Q: What is the legal framework that guarantees project security in Nepal?

To promote foreign direct investment (FDI) and reduce investment risks, the Government of Nepal approved the Hedge Fund Regulations 2019 on February 25, 2019. Similarly, the Public-Private Partnership and Investment Act 2019 has provisions to establish a Viability Gap Fund (VGF) for priority sector projects.

Q: Is environmental clearance compulsory for all industries?

No. Only certain industries that may have an impact on health and the environment are required to obtain environmental clearance.

Generally, EIAs are conducted in large scale projects like hydropower generation plants with capacity of more than 50 MW whereas hydropower generation projects with capacity of less than 50 MW are required to conduct IEE. Similarly, hotels with 50-100 beds are required to conduct IEE and hotels with more than 100 beds have to conduct EIA. Further, the law also provides for requirement to obtain pollution control certificate.